THE BIG STORY

Lower Prices and Lower Mortgage Rates

-

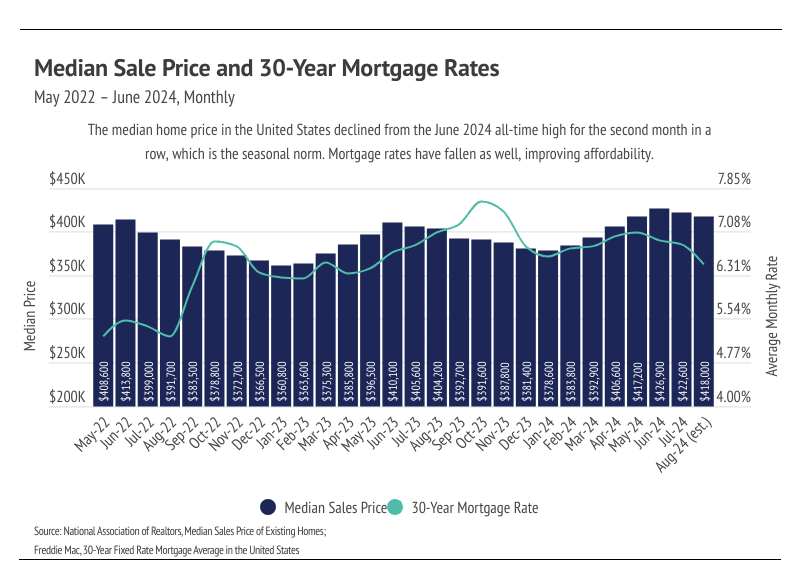

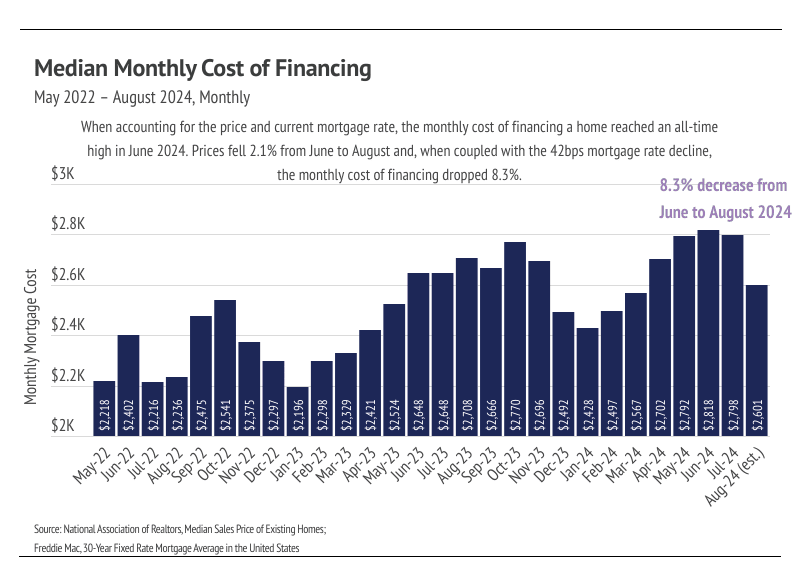

Nationally, the monthly cost of financing a median-priced home was 8.3% lower in August 2024 than in June because the median home price declined 2.1% over the past two months, and mortgage rates have dropped.

-

In August, the average 30-year mortgage rate declined for the third month to 6.35%, a 0.87% drop from the 2024 high reached in early May. The Fed is expected to cut rates by at least 0.25% in its September 17-18 meeting. Rate cuts will benefit the current market.

-

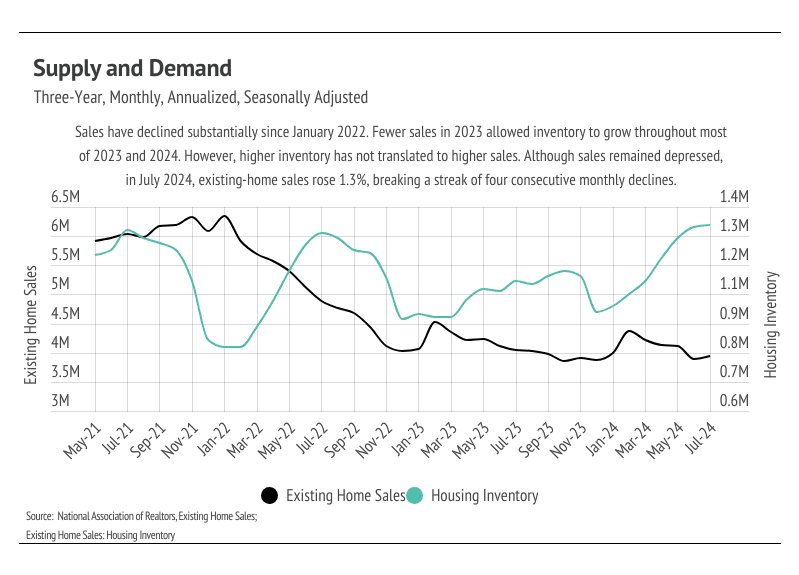

Sales rose 1.3% month over month, ending a streak of four consecutive monthly declines, while inventory rose to its highest level since 2020. Because sales have been so sluggish this year, we may see sales increase in the fall, as rates fall and homes become more affordable.

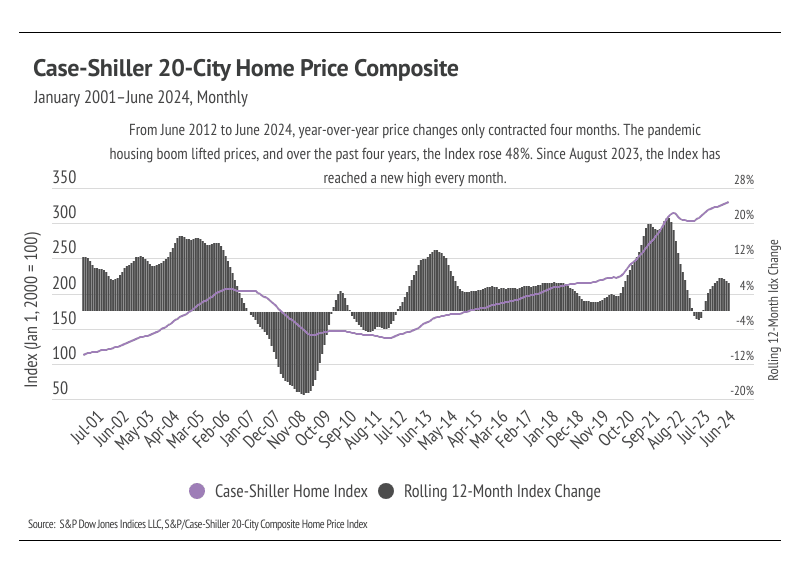

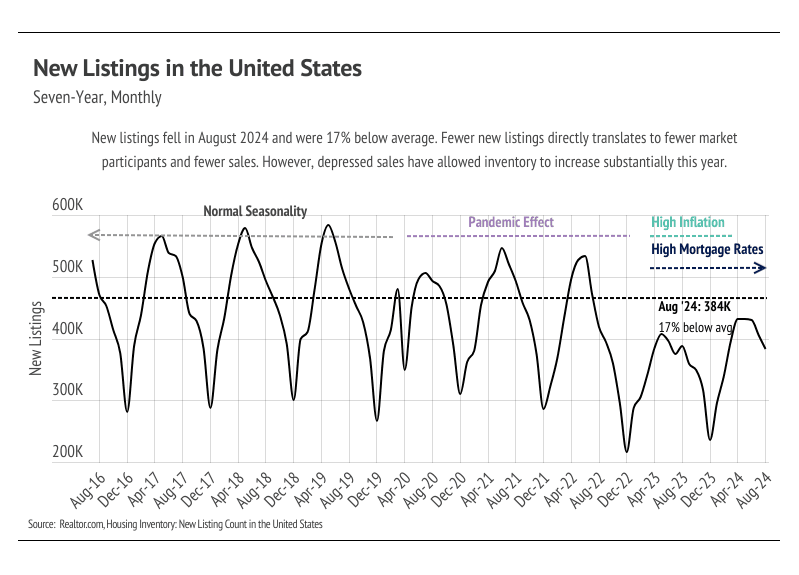

In June 2024, U.S. housing affordability hit a record low, with home prices and financing costs reaching their highest levels. However, by August 2024, affordability began improving due to a 0.51% drop in mortgage rates over the previous two months, reducing monthly payments by about 5%. While sales and inventory typically decline in the latter half of the year, 2023 and 2024 broke from this trend, with historically low sales and increased inventory, giving buyers more options. Sales rose slightly in August by 1.3% due to better affordability, and further improvements are expected as rate cuts may begin in mid-September. Entering 2025, falling rates, high inventory, and lower prices could create a favorable market for buyers, especially in spring. Local trends may vary, and ongoing monitoring will help guide real estate decisions.

THE LOCAL LOWDOWN:

Quick Take:

-

The median single-family home price fell 11.4% month over month, while condo prices declined 0.2%. We expect price contraction for the rest of the year, which is the seasonal norm.

-

Total inventory fell 10.3% month over month, as sales and homes under contract far outpaced new listings. We expect inventory to decline and the overall market to slow as we make our way through the second half of the year.

-

Months of Supply Inventory has declined month over month, indicating the market is improving for sellers. Currently, MSI indicates a sellers’ market for single-family homes and a balanced market for condos.

Median home prices declined month over month, which is the seasonal norm

Home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to January 2023. Since January 2023, the median single-family home and condo prices have trended horizontally. Year over year, the median price declined marginally, down 0.3% for both single-family homes and condos. Single-family home prices peaked in April 2022, and condo prices peaked in May 2022; they are currently at 21% and 8% below peak, respectively. Prices are more likely to rise if more sellers come to the market. Inventory is so low that rising supply will only increase prices as buyers are better able to find the best match. More homes must come to the market to get anything close to a healthy market. That said, inventory, sales, and price typically peak in the first half of the year, so we expect contraction across those metrics for the rest of the year. Inventory is still low enough that it should create price support as supply declines in the second half of the year.

High mortgage rates soften both supply and demand, but home buyers and sellers seemed to tolerate rates near 6% much more than around 7%. Now that rates are declining, sales could get a little boost, but the housing market typically begins to slow as we make our way into fall.