Note: You can find the charts & graphs for the Big Story at the end of the following section.

The labor market is too strong for a recession, so what’s the Fed to do?

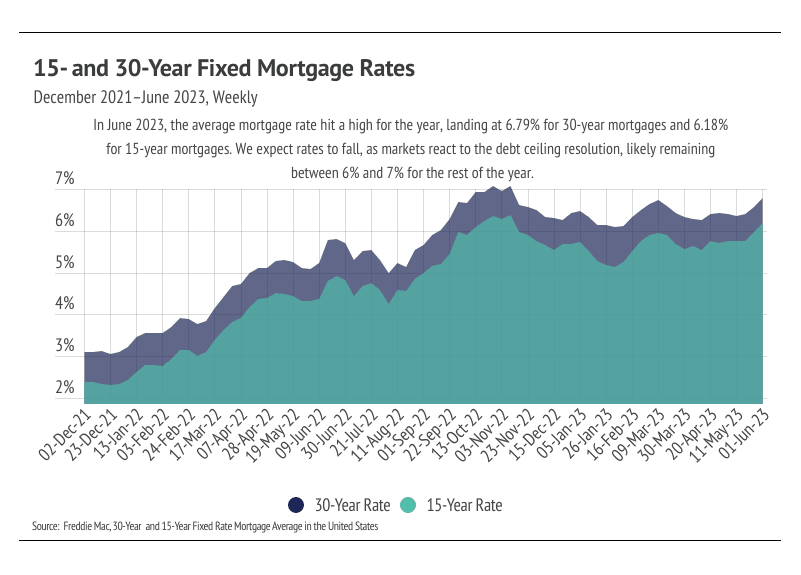

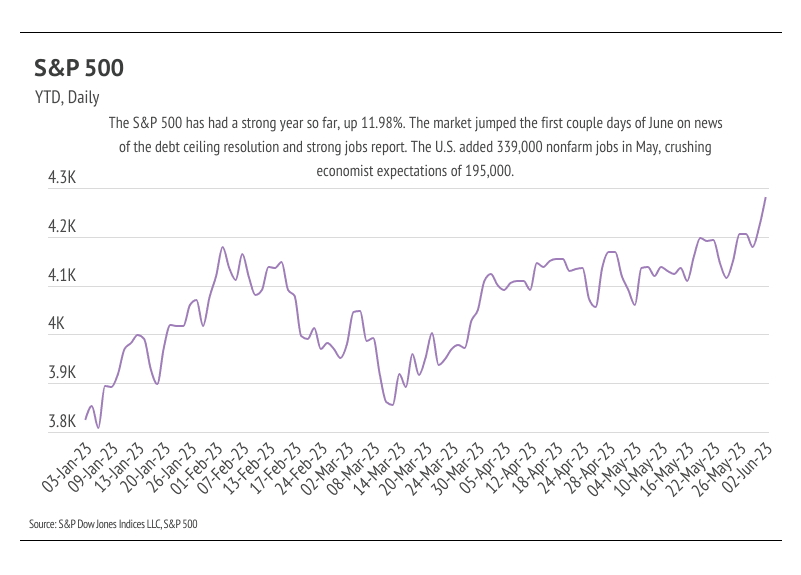

We did it, gang! We made it through another debt ceiling crisis! The United States paid its bills in full and on time, avoiding default and a global economic catastrophe with two days to spare. This self-inflicted wound would have had far-reaching negative economic consequences in the near and long term, including far higher mortgage rates. Financial markets were mostly unbothered despite the fact that this Congress seems to be the most amenable to default. The 10-year Treasury yield rose a modest 0.4% in May, which translated to a 0.4% increase in the average 30-year mortgage rate. The S&P 500, which tracks the stock of the 500 largest publicly traded U.S. companies, reached a high for the year at the beginning of June, up 12% year to date. To be fair, a debt ceiling resolution that didn’t totally destroy the U.S.’s global standing was the most probable scenario. Now that the debt ceiling has been lifted until 2025, we turn our sights back to the Fed and interest rates.

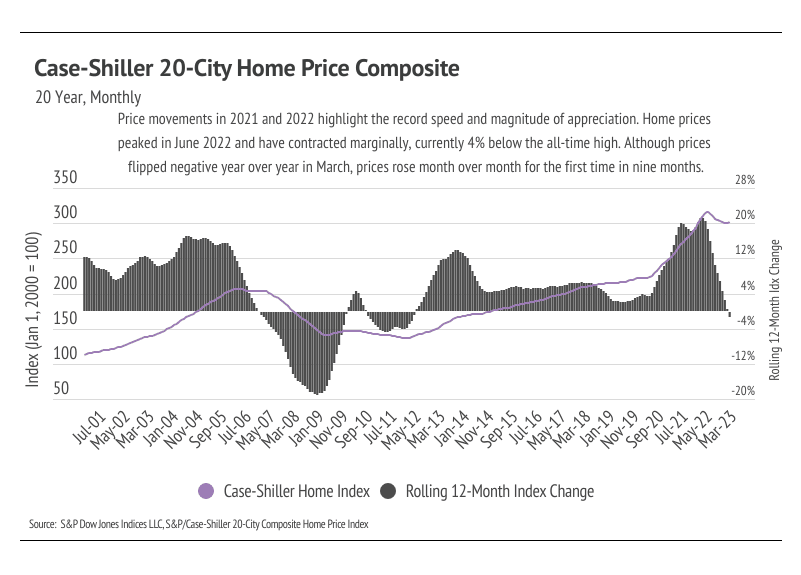

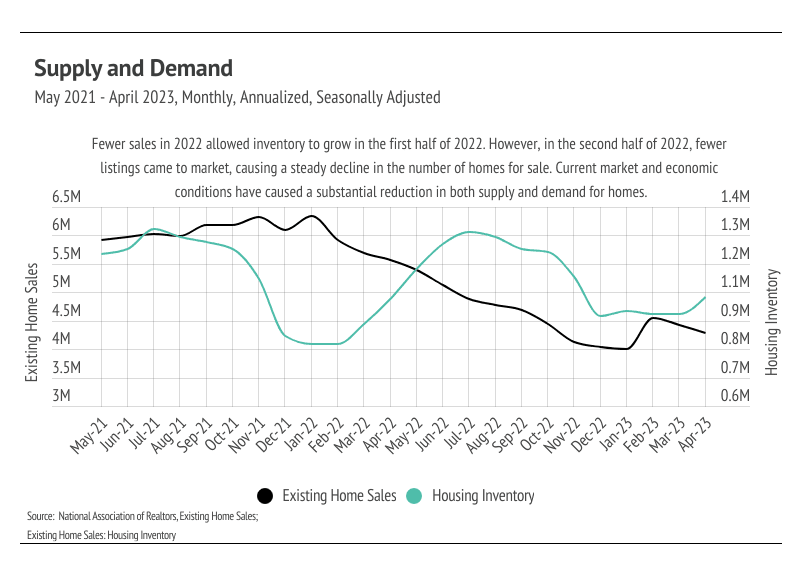

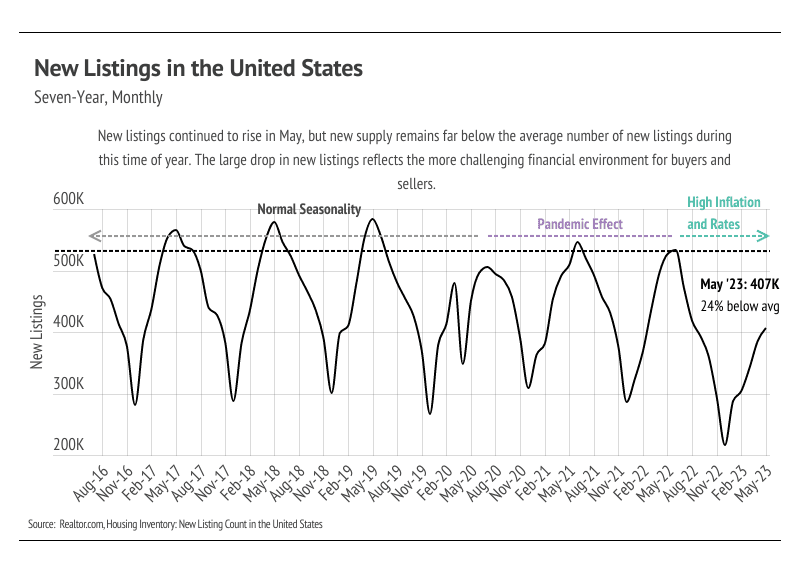

During their last meeting, the Fed forecasted a potential pause in rate hikes after three sizable regional bank failures this year, but recent jobs data may swing them back toward a 0.25% increase. Increasing mortgage rates have primarily driven the housing market slowdown we’ve experienced over the past 12 months. Higher rates affect the housing market so strongly because housing is typically financed. Potential buyers have struggled with mortgage rate volatility over the past 18 months, as the average 30-year mortgage rate went from historic lows in 2021 (~3%) to a 20-year high (~7%) in November 2022. Luckily, rates contracted but have remained around 6.5%. Because home prices nationally haven’t contracted substantially from their all-time highs, small rate changes can make a huge difference in the cost of financing. The average 30-year rate hit a 2023 high at the start of June. However, we still expect rates to stay within the 6-7% band this year. At this point, continued rate hikes tell us more about the length of time rates will stay high, since the Fed tends to move in smaller steps over time. This means that, for every step up, there will need to be a step down, which will prolong the process of returning to lower mortgage rates.

The Fed has a tricky decision regarding future rate hikes. The broad labor market has shown its strength and seeming immunity to rate hikes. The monthly increase in employment from the U.S. Bureau and Labor Statistics has beat Wall Street estimates for the 14th month in a row. In May alone, 339,000 jobs were created, crushing the expected 195,000 jobs. At the same time, however, unemployment rose from 3.4% to 3.7% from April to May. Additionally, the first-quarter 2023 GDP data was revised up from 1.1% to 1.3% quarter over quarter. With this mix of data, we’re expecting a rate hike pause at the June meeting, but a hike again in July.

The housing market is in an interesting spot, where the economy is too good to lower rates but homes have become too expensive for potential buyers. Fewer sellers and buyers are in the market, so sales are unlikely to grow meaningfully this year.

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage for your area. In general, higher-priced regions (the West and Northeast) have been hit harder by mortgage rate hikes than less expensive markets (the South and Midwest) because of the absolute dollar cost of the rate hikes and the limited ability to build new homes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

Big Story Data

The Local Lowdown

-

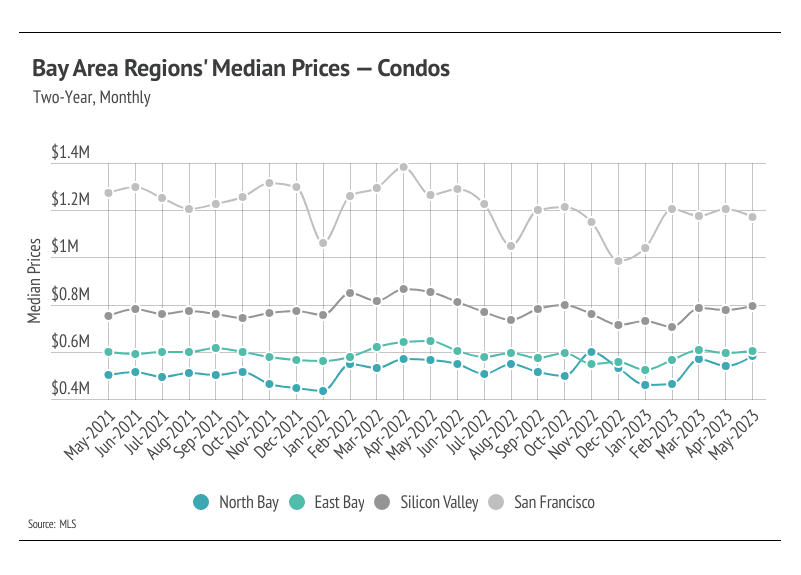

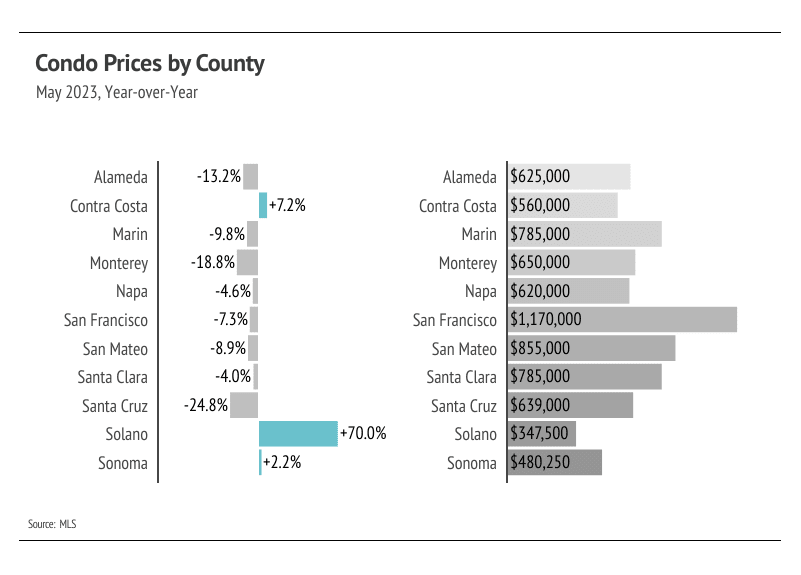

Home prices were up year to date through May 2023 across the Bay Area regions, although San Francisco has struggled with both inventory and price growth.

-

Sales are growing rapidly as more new listings hit the market to help satisfy excess demand in the Bay Area, driving prices higher.

-

Months of Supply Inventory has declined significantly in 2023, homes are selling more quickly, and sellers are receiving a greater percentage of asking price, all of which highlight an increasingly competitive environment for buyers.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Higher inventory, higher prices

The Bay Area has started to trend similarly in terms of price growth, sales, and inventory, but San Francisco is an island unto itself when it comes to housing. Prices and inventory in the North Bay, East Bay, and Silicon Valley have increased considerably because more listings are coming to market, so buyers are better able to find the right home for them. The lack of listings in San Francisco has proven challenging to buyers, and prices have continued to fall. However, it’s notable that even though the median price of a single-family home is 22% lower than last May, when adjusting for mortgage rate increases, the monthly cost is only 10% lower.

Last year, single-family home prices peaked in the beginning of the year as buyers rushed to lock in a lower mortgage rate. The Fed announced rate hikes at the end of 2021 that would swiftly affect rates in 2022. The average 30-year mortgage rate rose 2% in the first four months of 2022, crossing 5% for the first time since 2011. That 2% jump caused the monthly cost of financing to increase 27%, so buyers rightly rushed to the market. As rates rose higher, the market cooled and home prices fell in large part to accommodate the higher cost of a mortgage. Both supply and demand were lower than normal in the second half of 2022.

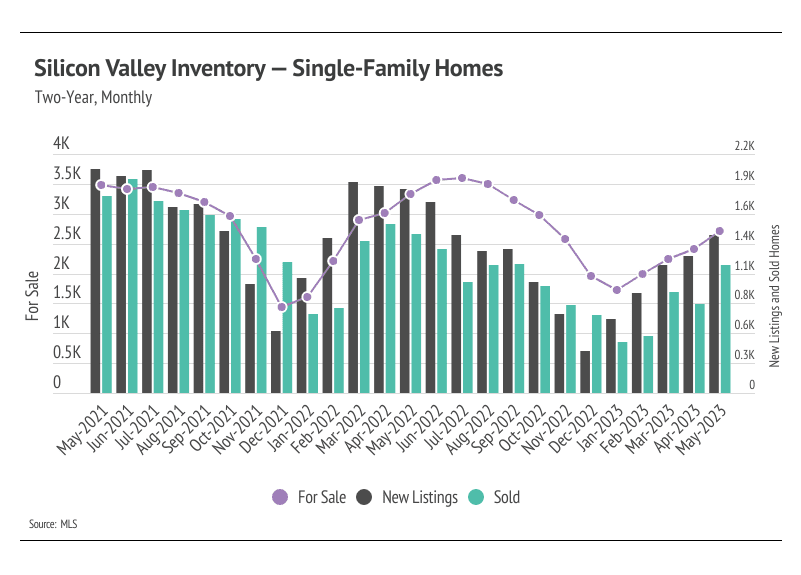

In 2023, demand started to rise again despite elevated mortgage rates and was met by a high number of new listings. Price increases this year have been largely a function of more homes coming to market and inventory growth, which is counterintuitive to supply and demand. Supply was so low that more homes were able to better match buyers to a desirable property, giving sellers more pricing power. As demand increases through the summer months, competition among buyers will climb with it, raising home prices.

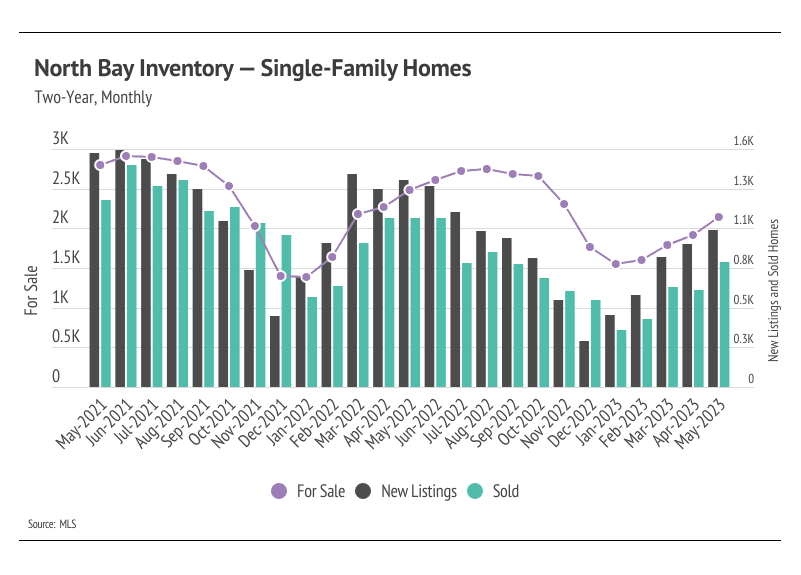

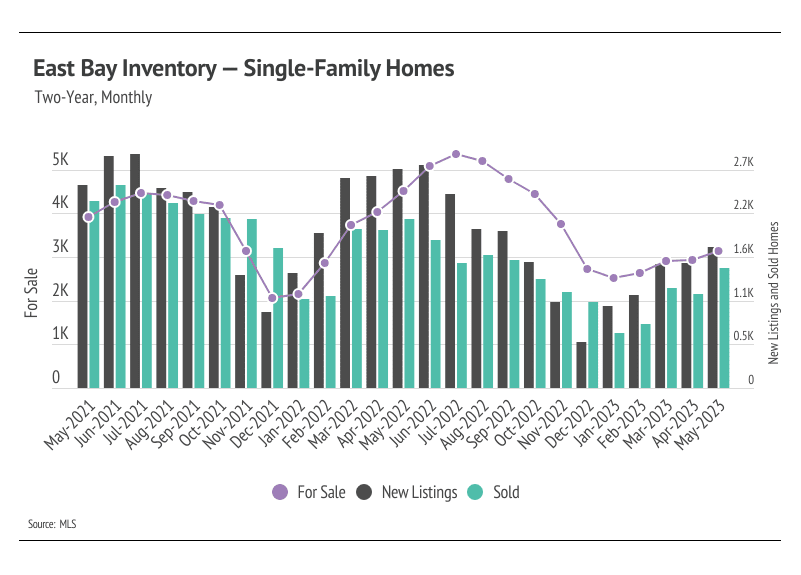

Inventory is rising, but sales are growing faster than new listings

Single-family home and condo inventory, sales, and new listings rose over the past four months, although all remain at depressed levels. The number of home sales is, in part, a function of the number of active listings and new listings coming to market. Even though all those metrics are far below typical levels, these trends are all signs of a healthier market. Currently, inventory is still quite low relative to demand, so far more new listings could come to the market. Potential sellers who have fully paid off their property are in a particularly good position if they don’t have to finance their next property after the sale of their home. Since January, sales jumped 125% while new listings rose 70%.

As buyer competition has ramped up and sellers are gaining negotiating power, sellers are receiving more of their listed price. In May 2023, the average seller received 3-5% more of their listed price as compared to January. Inventory will almost certainly remain historically low for the year and will likely only get more competitive in the summer months.

Months of Supply Inventory declined in May, moving further into a sellers’ market

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Bay Area market tends to favor sellers for single-family homes, which is reflected in its low MSI. However, we’ve seen over the past 12 months that this isn’t always the case — at least for San Francisco. Overall, MSI has trended lower over the past four months, indicating the market more strongly favors sellers. The sharp drop in MSI occurred due to the higher proportion of sales relative to active listings and less time on the market.

Local Lowdown Data